Banking & Financial Services. Detect masked fraud before it becomes financial crime.

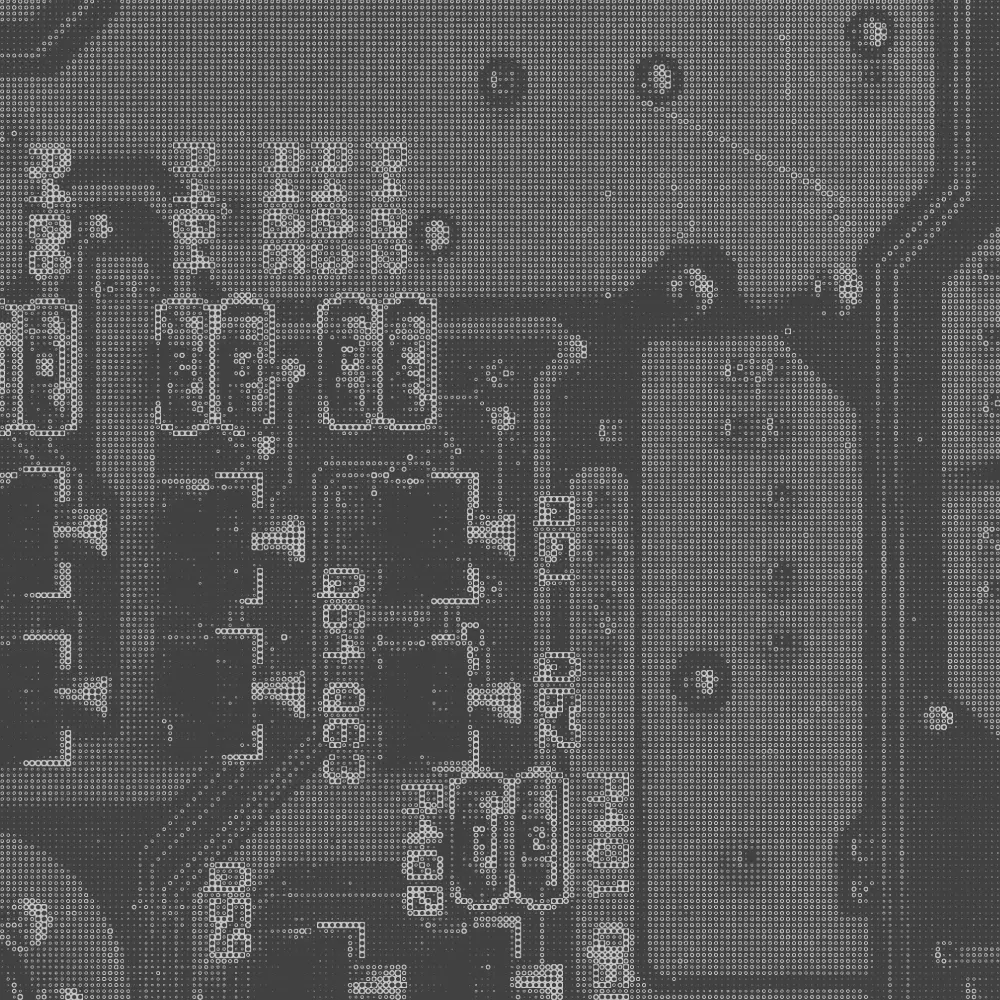

1 "client": {2 "city": "Weldon Springs"3 "behaviors": ["TOR_PROXY_USER"],4 "concentration": {5 "country": "US",6 "density": 0.202,7 "geohash": "9yz",8 "skew": 45,9 "state": "Missouri",

Banks face constant pressure from fraud, money laundering, and cybercrime as customers access services remotely. Spur exposes anonymized infrastructure behind logins and account activity, helping financial institutions detect abuse early without disrupting legitimate customers.

Anonymized Access Enables Fraud and Money Laundering.

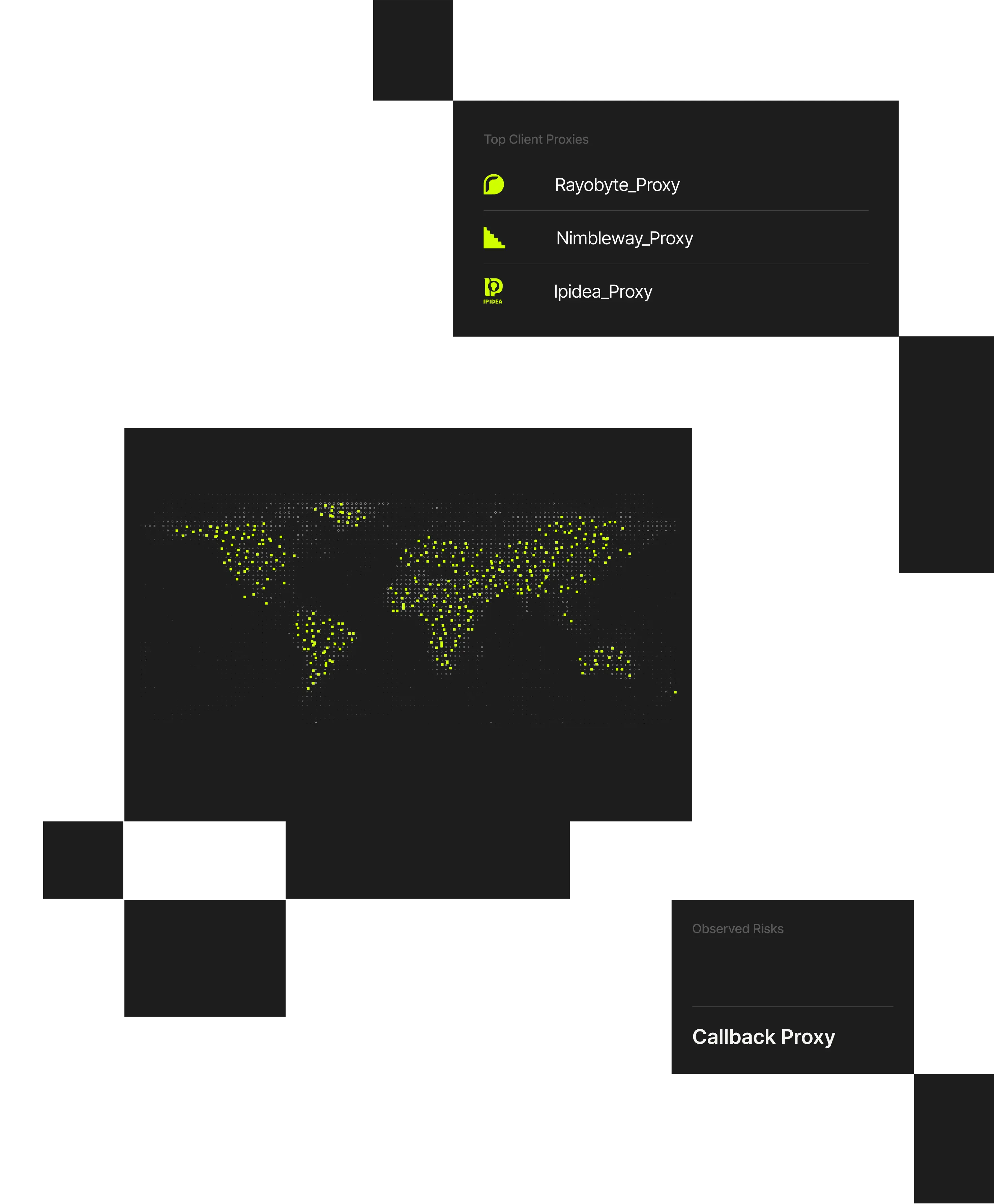

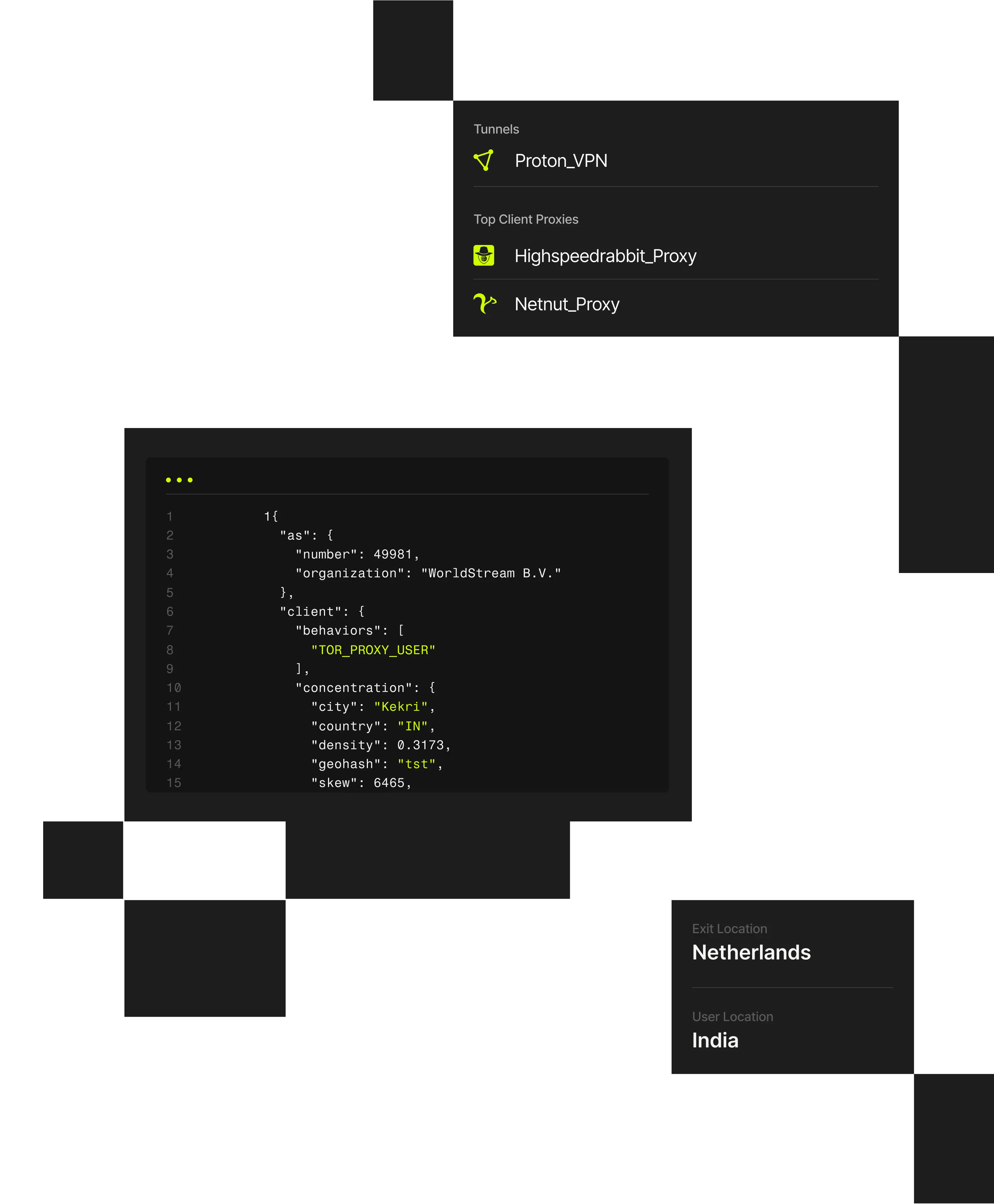

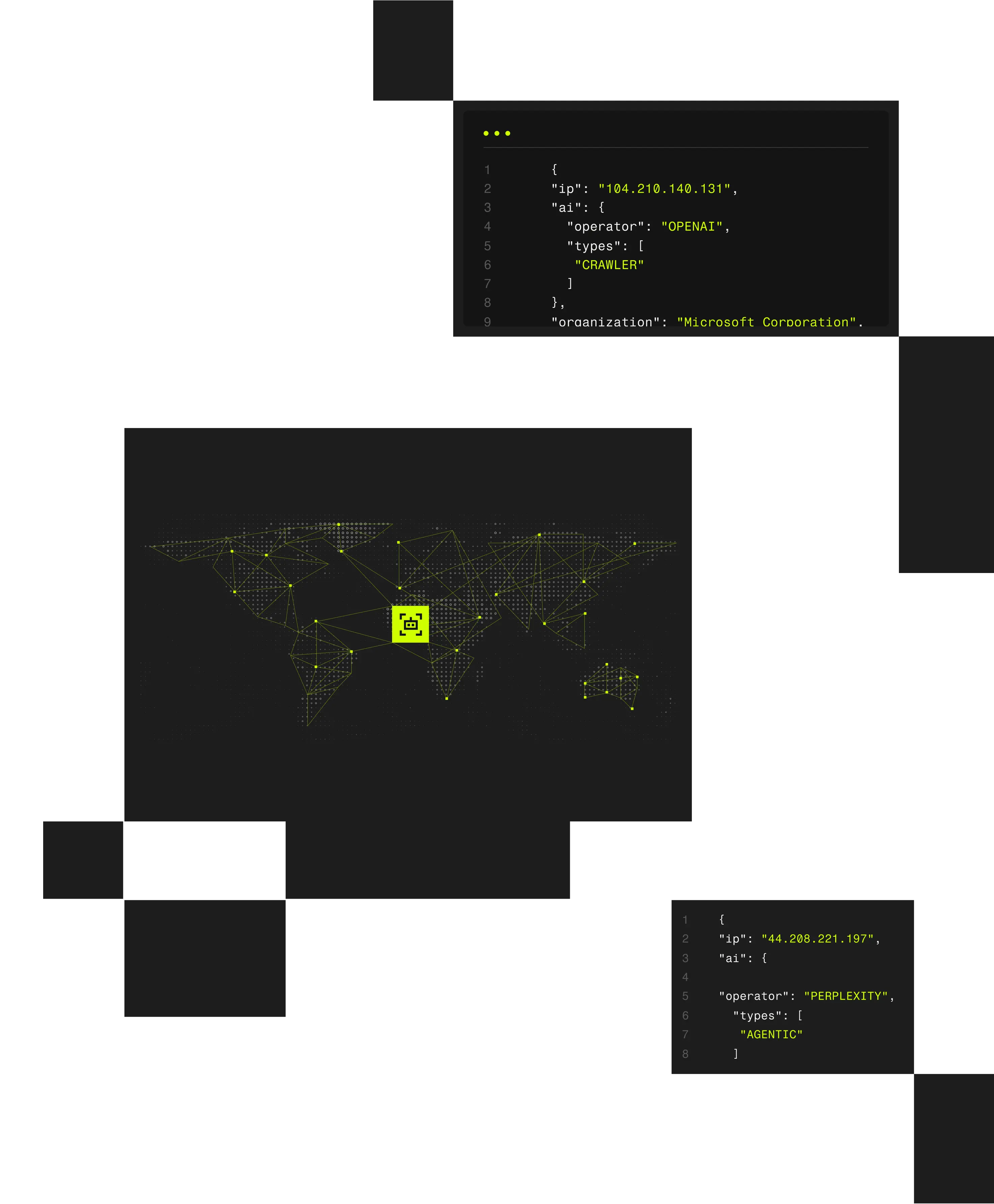

Retail and commercial banks rely on remote access for customer onboarding, authentication, and transactions. Attackers exploit this by routing activity through VPNs, residential proxies, and malware-driven infrastructure to impersonate users, bypass geographic controls, and open mule accounts at scale.

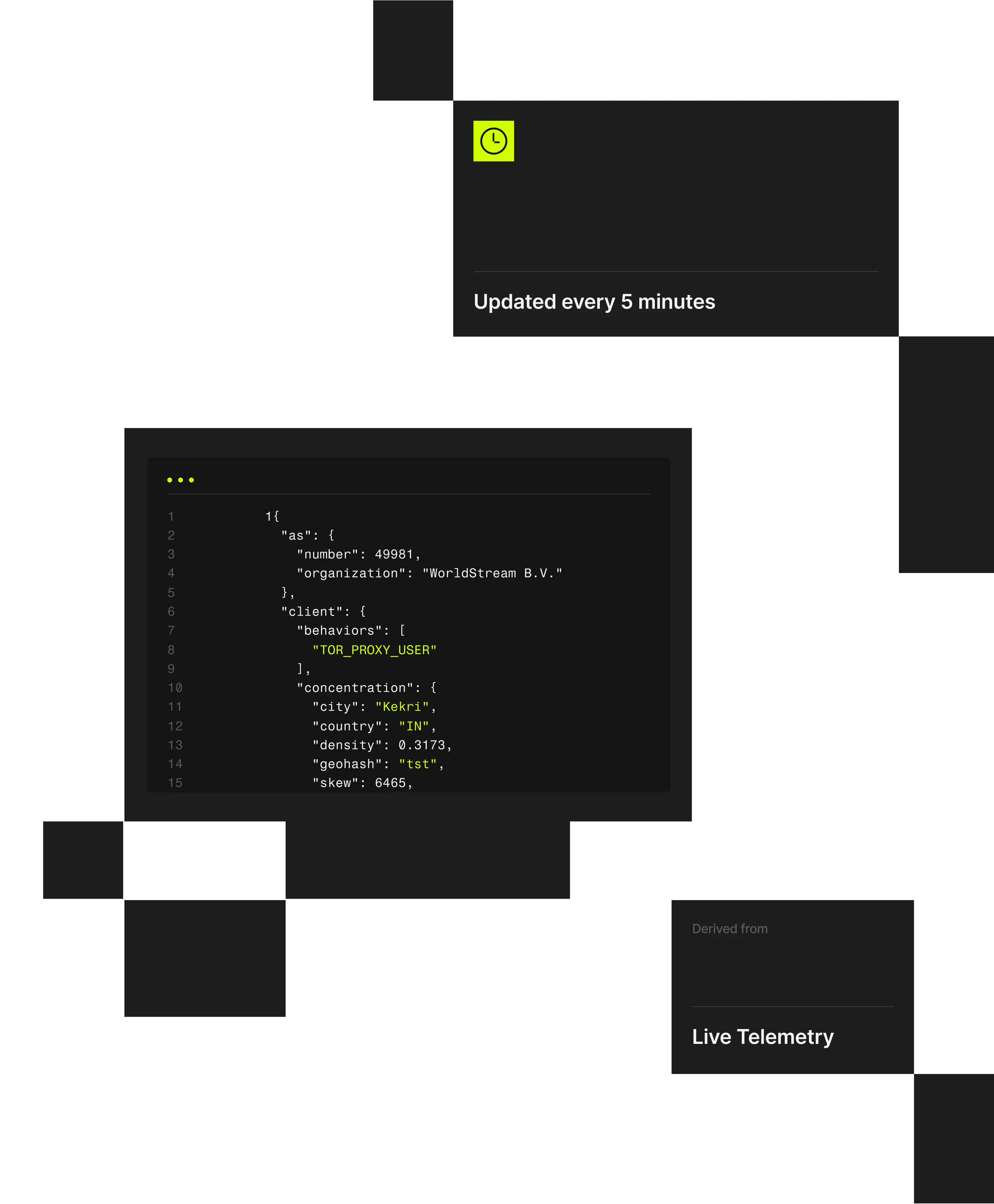

When access appears legitimate, fraud and AML controls lose effectiveness. Spur delivers infrastructure-aware IP enrichment that helps banks validate user sessions, identify high-risk access patterns, and strengthen fraud, KYC, and AML workflows.

Detect Fraud, Support KYC/AML, and Protect Account Integrity.

Spur provides infrastructure-aware IP intelligence that helps banks validate user sessions, identify anonymized access, and stop fraud and money laundering activity without introducing friction for legitimate customers.

Financial Institution Reduces Account Takeovers by Over 40%

A financial institution reduced successful account takeovers by more than 40% after enriching login and authentication workflows with infrastructure-aware IP intelligence.

By identifying VPN- and residential proxy-backed sessions during customer access, the bank was able to flag impersonation attempts, apply step-up verification when risk was elevated, and disrupt coordinated fraud activity without degrading the experience for legitimate customers.

Evidence You Can Act On.

Spur’s verified IP intelligence helps teams move faster, detect more, and protect what matters – without adding friction for real users.

230M+

Unique anonymized IPs detected every 90 days, distilled into 60M suspect IPs daily

1000+

VPN and proxy services detected

20+

Enrichment attributes for full context (geo, ASN, proxy type, device, tunnel entry/exit, etc.)

Reveal the truth hiding in plain sight across the sectors Spur protects.

Detect Fraud Before It Becomes Financial Crime.

Validate user sessions, detect anonymized access, and support KYC and AML workflows with infrastructure-aware IP intelligence built for modern financial environments.